Business Software for UK SMEs: Essential Tools for Operations

12 Feb, 2026Running a small business in the UK isn’t just about selling products or services-it’s about keeping the lights on, payroll running, invoices paid, and orders shipped on time. For UK SMEs, the right software isn’t a luxury. It’s the backbone of daily operations. Many business owners still rely on spreadsheets, paper files, or outdated systems that eat up hours every week. The good news? There are affordable, easy-to-use tools designed specifically for businesses like yours. Here’s what actually works in 2026.

Accounting Software: The Foundation

If your books are messy, everything else gets messy too. HMRC requires digital record-keeping for VAT-registered businesses, and even if you’re not registered, clean accounting saves you stress and money. QuickBooks Online is the most popular choice among UK SMEs, used by over 350,000 small businesses. It automatically pulls in bank transactions, tracks expenses, and generates VAT-ready reports. Xero is a close second, especially popular with accountants who manage multiple clients. Both integrate with UK banks like Barclays and HSBC, so you don’t have to manually enter every payment.

Don’t waste time on manual data entry. Tools like Receipt Bank let you snap a photo of a receipt, and it extracts the data, categorizes it, and sends it straight to your accounting software. One London-based bakery cut their bookkeeping time from 12 hours a week to under 3 hours just by using this.

Payroll and HR: Stay Compliant

Getting payroll wrong in the UK can cost you thousands in penalties. The government’s Real Time Information (RTI) system demands accurate, timely submissions. PayFit and Sage Payroll automate this. They calculate tax, National Insurance, pensions, and even sick pay automatically. They also handle auto-enrolment pensions under the Pensions Act 2008, which many small businesses miss.

For HR, Breathe HR is a lightweight, UK-focused tool that lets you manage contracts, leave requests, and performance reviews in one place. It’s especially useful for teams under 50 people. No more chasing employees for signed forms or losing holiday records in email threads.

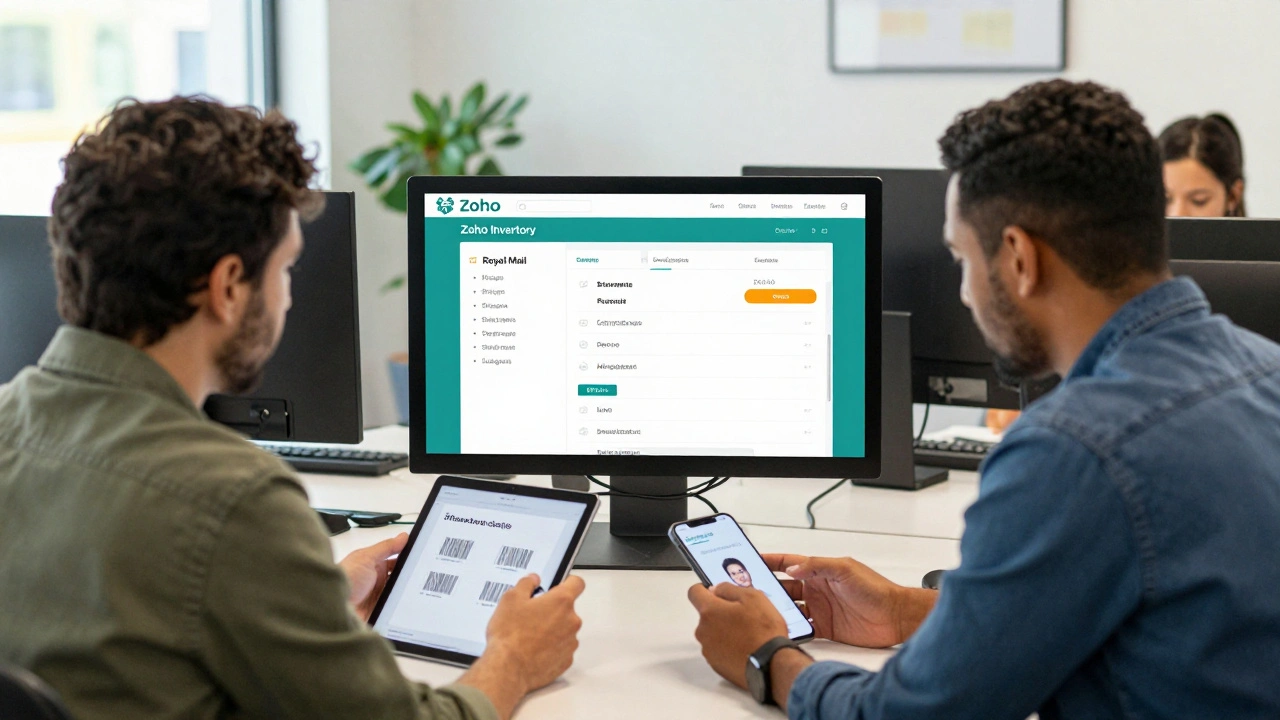

Inventory and Order Management: Stop Guessing

If you’re running a retail shop, warehouse, or even a craft business, you’ve probably had the panic moment: ‘Do we have enough stock for tomorrow’s big order?’ Zoho Inventory syncs with your online store (like Shopify or Etsy), tracks stock levels in real time, and even suggests reorder points based on sales history. One Manchester-based clothing brand reduced overstock by 40% and cut stockouts by 65% in six months.

For businesses that ship products, Shippo is a game-changer. It compares shipping rates from Royal Mail, DHL, and Parcelforce, prints labels automatically, and sends tracking info to customers. No more standing in line at the post office or overpaying for delivery.

Customer Relationship Management (CRM): Build Loyalty, Not Just Sales

Most UK SMEs think CRM is just for big companies. That’s wrong. HubSpot CRM is free, easy, and powerful. It lets you track every customer interaction-emails, calls, meetings-and set reminders to follow up. You can tag customers by interest, send automated birthday discounts, or trigger a thank-you email after a purchase. One Sheffield-based plumbing company used HubSpot to turn one-time customers into repeat clients by 30% in just nine months.

Pair it with Calendly for booking appointments. No more back-and-forth texts like, ‘Are you free Thursday?’ Calendly syncs with your calendar, lets customers pick a time, and sends automatic reminders. It cuts no-shows by nearly half.

Communication and Collaboration: Keep Everyone on the Same Page

Remote work isn’t going away. Even if you have a small team, you need a central hub for messages, files, and tasks. Microsoft Teams is the default for many UK SMEs because it’s included in Office 365 subscriptions. But Slack is more popular with creative teams-faster, more flexible, and integrates with Trello and Google Drive.

For task management, ClickUp is rising fast. It combines to-do lists, calendars, docs, and time tracking in one place. A Cardiff-based marketing agency switched from five different apps to ClickUp and saved 15 hours a week on meetings and status updates.

Security and Backup: Don’t Risk It

UK SMEs are targeted by cybercriminals more than ever. In 2025, over 50% of small businesses reported a cyberattack. You don’t need a fancy IT team. Start with Bitdefender GravityZone for antivirus and endpoint protection. It’s affordable and blocks ransomware before it locks your files.

For backups, Backblaze automatically backs up your computers and servers to the cloud. If your laptop gets stolen or your server crashes, you can restore everything in minutes. One Bristol-based design studio recovered all client files after a hardware failure-thanks to Backblaze. They didn’t lose a single project.

What to Avoid

Not all software is worth it. Avoid tools that:

- Require you to train your whole team for weeks

- Charge per user if you have fewer than 10 staff

- Don’t integrate with your existing tools (like your bank or online store)

- Have no UK-based customer support

Stick to tools with clear pricing, simple onboarding, and UK-specific features-like VAT reporting, RTI payroll, and Royal Mail shipping. Don’t chase features you don’t need. A tool with 20 functions you never use is worse than one with 5 you use every day.

Getting Started

You don’t need to buy everything at once. Start with one area that’s costing you the most time:

- Track where you lose hours each week-bookkeeping? invoicing? scheduling?

- Choose one tool that solves that problem.

- Set up a 14-day trial.

- Use it for two weeks. If it saves you time or reduces errors, keep it.

- Then move to the next pain point.

Most UK SMEs see a return on investment within 30 days. The goal isn’t to be tech-savvy-it’s to be less stressed, more efficient, and more profitable.

What’s the cheapest business software for UK SMEs?

The most affordable options are free or low-cost tools like HubSpot CRM (free), Zoho Inventory (free tier up to 50 orders/month), and Google Workspace (from £3.50/user/month). For accounting, Wave offers free bookkeeping, though it lacks UK-specific VAT features. For payroll, you can start with manual RTI filing if you’re under 10 employees, but automated tools like PayFit start at £15/month. The key is to start with one tool that solves your biggest bottleneck.

Do I need cloud-based software?

Yes. Cloud-based software means you can access your data from anywhere, backups are automatic, and updates happen without you doing anything. Local software (installed on one computer) is risky-if that computer crashes, you lose everything. Cloud tools like QuickBooks Online, Xero, and Microsoft Teams are designed to be secure, reliable, and always up to date. Most UK SMEs now use cloud software because it’s simply safer and easier.

Can I use US software in the UK?

Some can, but many can’t. US tools like FreshBooks or Square don’t handle UK VAT rules, RTI payroll, or HMRC reporting correctly. Even if they accept GBP payments, they may not generate the right invoice formats or tax codes. Stick with tools built for the UK-like Xero, PayFit, or Zoho Inventory. They’re designed to comply with UK law, support Royal Mail and DPD integrations, and have customer service teams in the UK.

How long does it take to set up business software?

It depends on the tool and your data. Accounting software like QuickBooks Online takes about 2-3 hours to connect your bank and enter your chart of accounts. CRM tools like HubSpot can be set up in under an hour if you import your existing contacts. Payroll and inventory tools may take a day or two if you have complex product lines or staff records. Most offer guided setup wizards. Don’t try to do it all in one day. Focus on one system at a time.

Should I hire someone to set up my software?

Only if you’re overwhelmed. Many tools have free onboarding webinars and step-by-step guides. If you’re short on time or unsure about VAT or payroll rules, hiring a bookkeeper or business advisor who specializes in SME software can save you headaches. Look for someone with experience in your industry-like a bookkeeper who works with cafes or e-commerce sellers. Don’t pay for generic IT support. You need someone who understands UK regulations and small business workflows.