Choosing Incoterms for UK Exports: DDP vs DAP and Other Options

1 Dec, 2025When you’re shipping goods from the UK to another country, who pays for the truck, the port fees, the customs clearance, or the final delivery? It’s not just about cost-it’s about control, risk, and who gets stuck with the bill when something goes wrong. That’s where Incoterms come in. These aren’t optional guidelines. They’re legally binding rules that define exactly what you, as the seller, are responsible for-and what your buyer handles. Get it wrong, and you could lose money, face delays, or even get stuck with a shipment you can’t recover.

What Are Incoterms, Really?

Incoterms are a set of 11 international trade terms published by the International Chamber of Commerce (ICC). They’ve been used since 1936 and updated every decade to reflect how global trade has changed. The latest version, Incoterms 2020, is the one you should be using today. These aren’t contracts. They’re not insurance policies. They’re a common language between buyer and seller that answers three basic questions:

- Who pays for each leg of the journey?

- Where does risk transfer from seller to buyer?

- Who handles customs paperwork and duties?

There are 11 terms, but for UK exporters, you’ll mostly deal with four: EXW, FCA, DAP, and DDP. The rest-like FOB or CIF-are more common in sea freight and less relevant for modern air or road shipments.

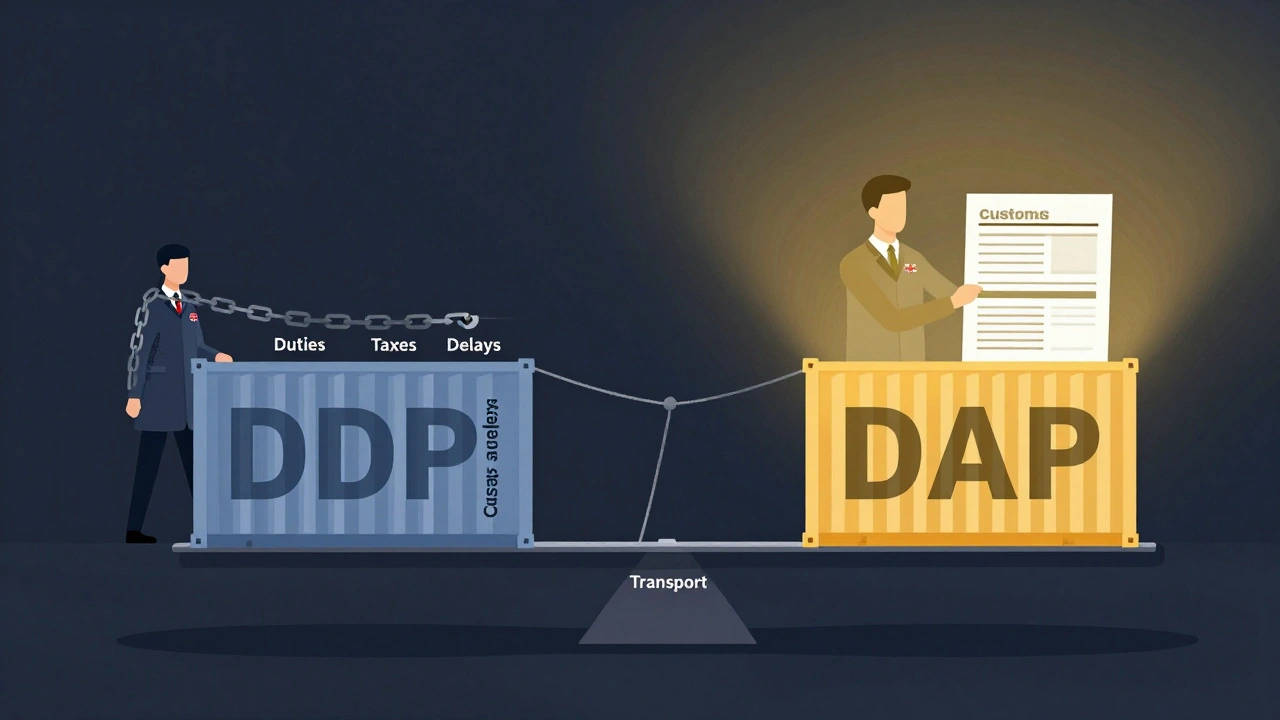

DDP: Delivered Duty Paid

DDP means you, the UK seller, handle everything-right up until the goods are handed over to the buyer at their door. You pay for transport, export clearance, import duties, taxes, and final delivery. You even arrange the customs declaration in the buyer’s country. It sounds like a no-brainer for the buyer, but it’s a big risk for you.

Here’s what that looks like in practice: You ship a batch of ceramic kitchenware from Manchester to a customer in Berlin. You book the truck, pay the German VAT (19%), handle the customs paperwork, and even pay the local delivery fee to their apartment. If the goods get held up at customs because of a missing document, it’s your problem. If the buyer refuses to pay the duties because they didn’t know about them, it’s still your problem. You’ve already paid them.

DDP is attractive because it makes your offer look seamless. Buyers love it. But you’re taking on all the risk-and the cost. If the buyer’s country suddenly changes import rules, or if your freight forwarder makes a mistake, you’re on the hook. Many UK exporters avoid DDP unless they have a local partner or agent in the destination country who can handle customs.

DAP: Delivered At Place

DAP is the middle ground. You deliver the goods to a named place-like a warehouse, terminal, or even the buyer’s front door-but you don’t pay the import duties or taxes. The buyer handles customs clearance and pays any fees when the goods arrive.

Let’s say you’re shipping industrial tools from Birmingham to a warehouse in Warsaw. You cover everything up to that warehouse: export paperwork, transport, insurance, and unloading. Once the truck arrives, your responsibility ends. The buyer then deals with Polish customs, pays the 23% VAT, and arranges the final move to their factory.

This is why DAP is the most popular choice for UK exporters right now. It gives you control over the main leg of the journey without forcing you to navigate foreign tax systems. You know your costs upfront. You don’t get surprised by unexpected duties. And if the buyer’s customs agent messes up, it’s not your problem.

But here’s the catch: Buyers often don’t understand what DAP means. They assume “delivered” means “all paid for.” If you don’t explain clearly, they might refuse to pay the duties, blame you, and delay payment. Always put DAP in writing and specify the exact delivery point: “DAP Warsaw Central Logistics Hub, Poland.”

Other Common Incoterms for UK Exporters

DDP and DAP aren’t the only options. Two others are worth knowing:

FCA: Free Carrier

FCA means you deliver the goods to a carrier you’ve chosen-usually at your warehouse or a nearby port. Once the carrier takes them, the buyer takes over. This is the most flexible term. You’re not responsible for anything beyond handing off the goods. It’s great if you’re working with a buyer who has their own freight forwarder. It’s also the safest for you if you’re shipping to a new country with unclear customs rules.

Example: You ship medical devices from Glasgow to a logistics hub in Chicago. You load them onto the buyer’s nominated truck at your facility. From there, they handle export clearance, ocean freight, and US customs. You’re done. No duties. No surprises.

EXW: Ex Works

EXW is the least responsibility you can have. You just make the goods available at your factory or warehouse. The buyer picks them up and handles everything else-export paperwork, transport, customs, delivery. It’s the cheapest for you, but the buyer has to be experienced. Most overseas buyers won’t agree to EXW unless they’re large importers with their own logistics teams. For small UK businesses, it’s rarely practical.

Why DAP Is the Smart Choice for Most UK Exporters

Let’s be real: Most UK SMEs don’t have a team in every country they ship to. You don’t have a customs broker in Brazil. You don’t have a local tax advisor in South Korea. So why would you take on DDP?

Here’s what a typical UK exporter should do:

- Use DAP for most shipments. It balances control and safety.

- Only use DDP if you have a trusted agent in the buyer’s country who can handle customs.

- Use FCA if your buyer has a reliable freight forwarder and you want to minimize your role.

- Avoid EXW unless you’re dealing with a large, experienced importer.

According to a 2024 survey by UK Export Finance, 68% of small and medium UK exporters now use DAP as their default Incoterm. Only 12% use DDP-and most of those are large companies with overseas subsidiaries.

What Happens If You Get It Wrong?

Imagine this: You ship a £15,000 order to a client in Spain under DDP. You pay the 21% VAT upfront. But the buyer claims they never agreed to pay for it. They refuse to reimburse you. Now you’re out £3,150-and you can’t reclaim it from Spanish customs because you’re not the importer of record.

Or worse: You use DAP but don’t specify the delivery point. The buyer says you should have delivered to their office. You delivered to the port. They refuse to pay until you move it. Now you’re stuck paying for storage and demurrage fees.

These aren’t hypotheticals. They happen every week. The UK government’s Trade Remedies Authority reported over 300 cases in 2024 where exporters lost money because of unclear Incoterms.

How to Avoid the Mistakes

Here’s what to do every time you ship:

- Write the Incoterm clearly on your invoice and contract: “DAP [City, Country]” - never just “DAP.”

- Specify the exact delivery point-not “buyer’s premises,” but “buyer’s warehouse, 123 Industrial Park, Lyon, France.”

- Never assume the buyer knows what DDP means. Send them a one-page summary: “Under DDP, we pay all duties. Under DAP, you pay import taxes.”

- Use a freight forwarder who understands Incoterms. Many cheap couriers don’t. Ask them: “Do you handle customs clearance under DAP?” If they hesitate, find someone else.

- Check the destination country’s rules. Some countries, like Brazil or India, have complex import systems. DDP here is risky unless you have local support.

Bottom Line: Know Your Risk, Know Your Cost

Incoterms aren’t about being nice to your buyer. They’re about protecting your profit. DDP looks generous, but it’s expensive and risky. DAP gives you control without overextending. FCA is your safety net if your buyer is experienced. EXW? Only if you’re sure they can handle it.

For most UK exporters in 2025, DAP is the sweet spot. It’s clear, it’s safe, and it keeps you in control. But only if you use it right. Write it down. Specify the place. Explain it to your buyer. And never, ever skip the paperwork.

What’s the difference between DDP and DAP?

Under DDP, the seller pays all costs, including import duties and taxes, and delivers the goods to the buyer’s door. Under DAP, the seller delivers the goods to a named place but doesn’t pay import duties-the buyer handles those. DDP shifts more risk and cost to the seller; DAP keeps the seller in control without taking on foreign tax obligations.

Is DDP better for my UK business?

Only if you have a local partner in the buyer’s country who can handle customs and pay duties on your behalf. Otherwise, DDP exposes you to unexpected costs, delays, and legal risks. For most UK exporters, DAP is safer and more predictable.

Can I use DAP for air freight?

Yes. DAP works for air, road, rail, or sea freight. It’s one of the most flexible Incoterms. Just make sure you specify the exact delivery point-like “DAP Frankfurt Airport Cargo Terminal” or “DAP Buyer’s Warehouse, Milan.”

What if my buyer refuses to pay import duties under DAP?

If you’ve clearly stated DAP in your contract and invoice, the buyer is legally responsible. If they refuse, you can withhold the release of goods until payment is made. Many freight forwarders will hold the shipment until duties are settled. Never release goods without payment of import fees under DAP.

Do I need to use Incoterms on my invoice?

Yes. Incoterms must be clearly stated on your commercial invoice and sales contract. Writing “FOB” or “DDP” without specifying the location is not enough. Always include the full term with the place: “DAP London, UK.” Without this, your shipment could be delayed or disputed.

Are Incoterms legally binding?

Yes. Incoterms are recognized globally under the UN Convention on Contracts for the International Sale of Goods (CISG). If they’re written into your contract, they’re enforceable in court. Ignoring them can lead to costly disputes, delays, or loss of payment.

For UK exporters, the key isn’t choosing the most generous term-it’s choosing the one that matches your capacity. DAP gives you the control you need without the risk you can’t afford.