Fraud Prevention for UK Online Stores: Essential Strategies to Protect Your Ecommerce Business

5 Dec, 2025One in every 12 transactions on UK online stores ends in fraud. That’s not a guess-it’s what the UK Finance report from early 2025 showed. For small and mid-sized ecommerce businesses, that’s not just a number. It’s a lost sale, a chargeback fee, a ruined customer trust, and maybe even a bank account freeze. If you’re running an online store in the UK, you’re already a target. The question isn’t whether fraud will hit you-it’s when, and how badly.

How Fraud Actually Works in UK Ecommerce

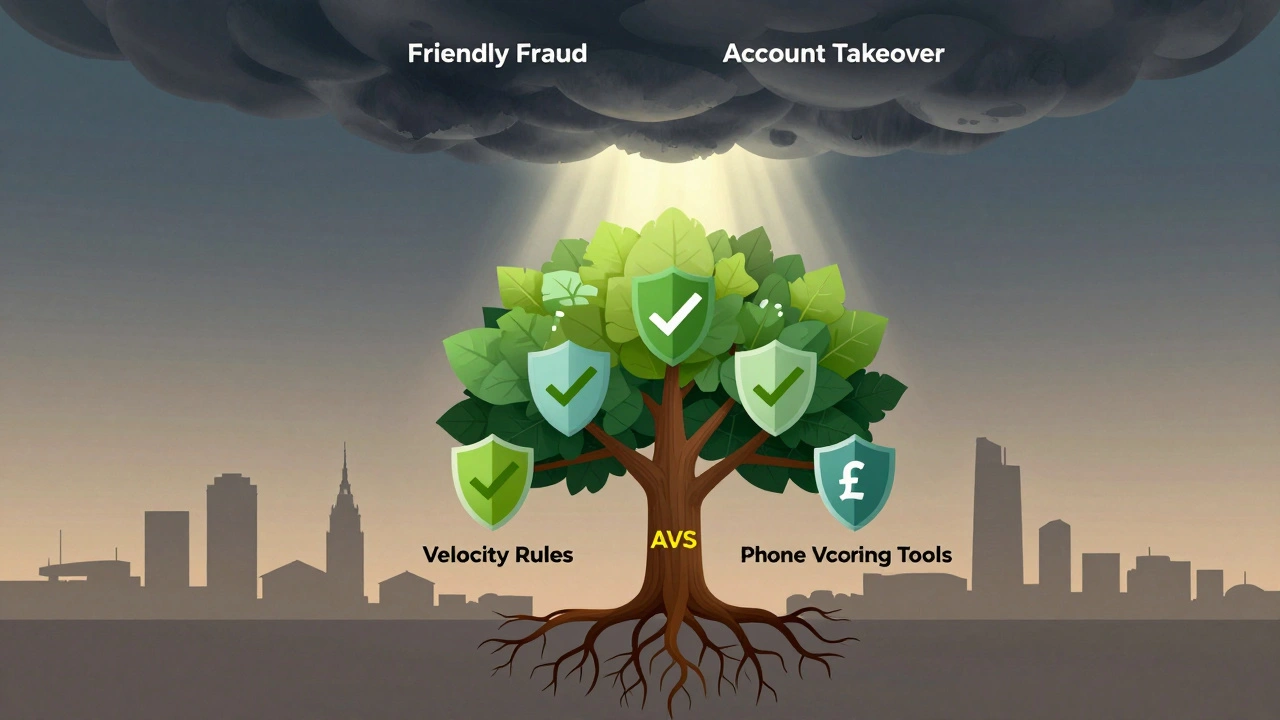

Fraud isn’t some shadowy hacker breaking into your server. Most of the time, it’s simple: someone uses a stolen credit card to buy high-value items-wireless headphones, gaming consoles, designer clothes-and ships them to a different address. The cardholder spots the charge, disputes it, and the bank reverses the payment. You lose the product, the money, and pay a £15-£25 chargeback fee. And if it happens too often, your payment processor may shut you down.

Another common type is account takeover. A fraudster gets hold of a real customer’s login details-maybe from a data leak on another site-and logs in to your store. They change the shipping address, use saved payment methods, and clear out the cart. Because the login looks legitimate, your system doesn’t flag it. You ship the goods. The customer calls you weeks later: "I didn’t order this."

Then there’s the "friendly fraud" problem. A customer buys something, uses it, then claims they never received it-or says they didn’t authorize it-to get a refund. They keep the product and get their money back. It’s dishonest, and it’s rising fast. A 2024 study by the UK’s Payment Systems Regulator found friendly fraud increased by 37% in 12 months.

Five Must-Do Fraud Prevention Steps for UK Stores

You don’t need a $50,000 security team to protect your store. Here’s what actually works for small to medium businesses:

- Enable 3D Secure 2 on all payments. This is the extra step where the customer enters a code sent to their phone or approves the payment through their bank’s app. It shifts liability from you to the card issuer. If a transaction is authenticated with 3D Secure 2 and later disputed, you won’t lose the money. Most UK payment gateways like Stripe, Worldpay, and PayPal support it-turn it on.

- Use address verification (AVS). Make sure the billing address on the card matches the one entered at checkout. If they don’t match, flag the order for manual review. Don’t just accept it. A mismatch is one of the clearest red flags.

- Set velocity rules. If the same card or email tries to place five orders in 10 minutes, block it. Fraudsters test cards fast. Set limits: no more than two orders per card per day, or no more than £500 in total per card in 24 hours. Most ecommerce platforms like Shopify and BigCommerce let you set these rules in the fraud detection settings.

- Require phone verification for high-risk orders. If someone buys a £600 laptop and ships it to a warehouse in Manchester, call them. Ask: "Is this your order?" If they can’t answer or hang up, cancel it. You’ll lose a few legit customers, but you’ll stop dozens of fraud attempts.

- Use a fraud scoring tool. Tools like Signifyd, Kount, or Sift analyze hundreds of signals-IP location, device fingerprint, shipping speed, historical behavior-and give each order a risk score. For £20-£50 a month, you get automated decisions: approve, review, or deny. These tools work with UK banks and know local fraud patterns.

What Not to Do

Some common "solutions" make things worse.

Don’t ask for CVV on every order. It’s a pain for customers, and it doesn’t stop fraudsters who already have the card details. Only ask for it if the order is flagged by your system.

Don’t ship to PO boxes or freight forwarders without extra verification. Many fraudsters use them to hide their real location. If you must ship there, require a phone call and proof of identity.

Don’t ignore low-value orders. Fraudsters often test cards with £5 purchases before hitting you with £300 ones. Track patterns, not just order size.

Don’t assume your payment provider handles everything. Stripe and PayPal offer tools, but they don’t automatically block all fraud. You still need to set rules and review flagged orders.

How UK Ecommerce Laws Protect You

The UK has strong rules for chargebacks under the Payment Services Regulations 2017. If you follow industry best practices-like using 3D Secure, verifying addresses, and keeping good records-you can fight back against false disputes.

If a customer claims they didn’t authorize a payment, you can submit evidence: the IP address, delivery confirmation, phone call logs, or even a screenshot of the checkout page showing the customer entered their own email. If your evidence is solid, the bank must reverse the chargeback in your favor.

Also, under the Consumer Rights Act 2015, customers can’t claim a refund just because they changed their mind after using the product. If they say "I didn’t receive it" but tracking shows delivery to their door, you can dispute the claim. Keep delivery proof for at least 12 months.

Real Example: How a London Bike Shop Cut Fraud by 82%

London Bikes Direct sold high-end e-bikes priced between £1,200 and £3,500. In 2023, they lost £18,000 to fraud in six months. They tried nothing-just accepted orders.

In January 2024, they did three things:

- Turned on 3D Secure 2 with Stripe

- Set a rule: no orders over £1,000 shipped to non-residential addresses without a phone call

- Started using Signifyd for automated risk scoring

By March, chargebacks dropped from 4.7% of sales to 0.8%. They saved £15,000 in one quarter. Their customer service team went from spending 10 hours a week on fraud disputes to under two.

They didn’t block customers. They just started asking questions before shipping.

What to Do When Fraud Hits

Even with all the right tools, fraud will slip through. When it does:

- Don’t panic. Don’t cancel the order until you’ve reviewed the evidence.

- Check the IP address. Is it from a known proxy or VPN service? Tools like MaxMind can tell you.

- Look at the email. Is it a disposable address like tempmail.org? That’s a red flag.

- Call the customer. Use the phone number they provided. If it’s disconnected or goes to voicemail, be suspicious.

- If you’re sure it’s fraud, cancel the order and refund the payment before the chargeback hits. You’ll lose the product, but you’ll avoid the fee and keep your chargeback rate low.

Keep a log. Name, email, IP, card last four digits, shipping address, time. If you see the same pattern repeat, you can block it next time.

Future-Proofing Your Store

Fraud will keep changing. In 2025, AI-generated voice calls are being used to trick customer service into approving refunds. Deepfake videos are being used to fake identity verification.

Stay ahead by:

- Updating your payment gateway every six months

- Training your team to spot new fraud signs

- Joining the UK Finance Fraud Intelligence Network-it’s free for merchants and gives real-time alerts on emerging scams

- Watching for new UK regulations. The Financial Conduct Authority is pushing for mandatory fraud prevention checks on all high-risk transactions by 2026

Don’t wait for a big loss to act. Fraud prevention isn’t a one-time setup. It’s a habit. Check your fraud settings every month. Review your chargeback reports. Talk to your payment provider. Small steps, done consistently, stop most fraud before it starts.

How common is ecommerce fraud in the UK?

In 2024, UK ecommerce fraud totaled £1.2 billion, up 22% from the year before. One in every 12 transactions is flagged as suspicious, and about 1 in 25 results in a chargeback. Small businesses are hit hardest because they often lack automated tools.

Can I prevent all fraud?

No, you can’t prevent all fraud-but you can reduce it by 80% or more with the right tools and habits. The goal isn’t zero fraud. It’s keeping your chargeback rate below 1%, which most payment processors require to avoid penalties or account closure.

Do I need to use a paid fraud tool?

Not if you’re just starting out. Turn on 3D Secure 2, use address verification, and manually review orders over £500. Once you’re processing 50+ orders a week, a tool like Signifyd or Kount pays for itself. They cost £20-£50/month but save hundreds in chargebacks.

What’s the biggest mistake UK store owners make?

They assume their payment provider handles everything. Stripe, PayPal, and others offer tools, but they don’t auto-block fraud unless you set rules. If you don’t configure velocity limits, AVS, or phone verification, you’re leaving the door open.

How do I know if my chargeback rate is too high?

Most payment processors allow up to 1% chargebacks per month. If you’re above that for three months in a row, you’ll get warnings. Above 1.5%, you risk being suspended. Check your processor’s dashboard monthly. If you’re seeing more than one chargeback per 100 sales, it’s time to act.

Next Steps for Your Store

Here’s what to do this week:

- Log into your payment gateway (Stripe, Worldpay, etc.) and turn on 3D Secure 2.

- Set a rule: block orders over £300 if the billing and shipping addresses don’t match.

- Review your last 20 orders. Look for patterns: same IP, same email domain, multiple cards used.

- Call one customer from a high-risk order. Just ask: "Hi, is this your order?" You’ll learn more in five minutes than any tool can tell you.

Fraud doesn’t vanish overnight. But if you take these steps, you’ll go from being a target to being a hard nut to crack. And that’s how you protect your business.