Operational Metrics for UK SMEs: Key Efficiency and Productivity Benchmarks to Track

28 Jan, 2026Running a small or medium-sized business in the UK isn’t just about selling more or cutting costs. It’s about knowing what’s actually working-and what’s dragging you down. Too many SME owners guess their way through performance. They look at turnover, check bank balances, and call it a day. But that’s like driving with your eyes closed. You might get somewhere, but you won’t know how fast, how safely, or if you’re even on the right road.

Why Operational Metrics Matter More Than Ever for UK SMEs

In 2026, UK SMEs are facing tighter margins, rising energy costs, and labor shortages. The Office for National Statistics reported that 43% of small businesses with 10-49 employees saw profit margins shrink by more than 5% last year. Meanwhile, companies that tracked at least five core operational metrics saw a 22% higher chance of maintaining or growing profits.

Operational metrics aren’t fancy reports for consultants. They’re simple, daily signals that tell you if your business is running smoothly-or if something’s broken. Think of them as your car’s dashboard: fuel level, engine temperature, oil pressure. You don’t wait for the engine to seize before you check.

Top 5 Operational Metrics Every UK SME Should Track

Not all metrics are created equal. Some look impressive but tell you nothing useful. Others are quiet, simple, and brutally honest. Here are the five that actually move the needle for UK SMEs.

1. Revenue per Employee

This one’s simple: total revenue divided by the number of full-time equivalent staff. For UK SMEs, the average is around £128,000 per employee, according to the Federation of Small Businesses (FSB) 2025 survey. But top performers hit £180,000 or more.

If your number is below £100,000, ask why. Are staff underutilized? Is there too much manual work? Are you hiring too fast without process? A drop here doesn’t mean you need to lay people off-it means you need to streamline.

2. Order Fulfillment Cycle Time

How long does it take from when a customer orders to when they get their product or service? For service-based SMEs (like plumbers, accountants, or consultants), this means from booking to completion. For product sellers, it’s from payment to delivery.

The national average for UK SMEs is 3.8 days. But businesses that cut this to under 2 days saw 31% higher customer retention, according to a 2025 study by the Institute of Directors. If your cycle time is over 5 days, you’re losing trust-and repeat business.

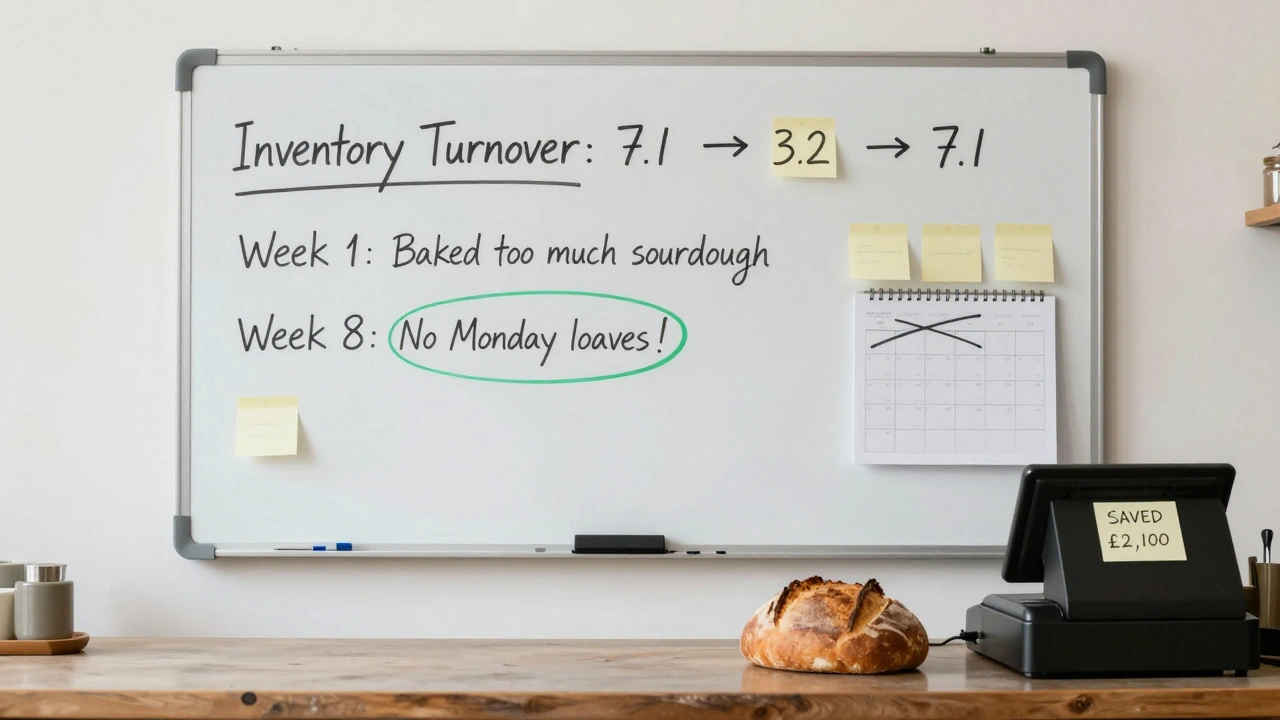

3. Inventory Turnover Ratio

For SMEs that stock goods, this is critical. It’s calculated as cost of goods sold divided by average inventory value. A ratio of 6-8 means you’re selling through stock every 2-3 months. That’s healthy.

But if your ratio is below 4, you’re tying up cash in unsold stock. If it’s above 12, you’re probably running out too often and losing sales. One London-based kitchenware retailer fixed their inventory issues by switching from monthly bulk orders to weekly deliveries based on real-time sales data. Their turnover jumped from 3.2 to 7.1 in six months.

4. Employee Utilization Rate

This isn’t about working longer hours. It’s about working on the right things. Calculate it as: (billable or productive hours) ÷ (total paid hours) × 100.

For professional services (consultants, designers, agencies), a healthy rate is 70-80%. Below 60%? You’ve got a problem. Maybe people are stuck in admin, or you’re over-hiring for peak times. One Manchester marketing firm found their team spent 40% of their time on invoicing and emails. They automated billing and hired a part-time bookkeeper. Utilization jumped to 78%-and profits rose 19%.

5. Customer Acquisition Cost (CAC) vs. Customer Lifetime Value (LTV)

CAC is how much you spend to win a new customer. LTV is how much that customer spends over their lifetime with you.

The rule of thumb? LTV should be at least 3x your CAC. If it’s less, you’re burning cash on marketing that doesn’t pay off. UK SMEs average a CAC of £187 and an LTV of £562. That’s a 3:1 ratio-just barely acceptable.

But if your LTV is £300 and your CAC is £250? You’re in trouble. You need to either lower your acquisition spend or increase retention. Simple fixes: loyalty discounts, follow-up emails, bundled services. One Sheffield-based fitness studio added a free monthly check-in for returning clients. Their LTV rose 41% without spending more on ads.

What to Avoid: The 3 Most Common Metric Mistakes

Even when SMEs track metrics, they often get it wrong. Here are the mistakes that waste time and mislead decisions.

Mistake 1: Tracking Vanity Metrics

Website visits, social media likes, newsletter sign-ups. These feel good-but they don’t pay the rent. A business with 10,000 website visitors and 10 sales is worse off than one with 1,000 visitors and 100 sales. Focus on conversion rates, not traffic.

Mistake 2: Measuring Too Much

Trying to track 20 KPIs means you’re tracking nothing. Pick five. Master them. Review them weekly. Change them quarterly. If you’re not acting on a metric, don’t track it.

Mistake 3: Comparing to Big Companies

Don’t benchmark yourself against Amazon or Tesco. They have different models, scale, and resources. Use SME-specific benchmarks: FSB, Institute of Directors, or industry-specific SME surveys. Your goal isn’t to be a giant. It’s to be efficient.

How to Start Tracking Without Overhauling Your Business

You don’t need expensive software. You don’t need a data team. Here’s how to begin in under a week.

- Choose your 5 metrics from above. Write them down.

- Find the data. Use your accounting software (QuickBooks, Xero), calendar tools, or even a simple spreadsheet.

- Set a fixed day each week-say, Monday morning-to update numbers.

- Ask: What changed? Why? What’s one small thing we can fix this week?

- Repeat. After 8 weeks, you’ll know what’s working and what’s not.

One Bristol-based bakery started tracking order fulfillment time and inventory turnover. They noticed they were baking too many sourdough loaves on Mondays. Turns out, no one bought them on Mondays. They stopped baking them. Saved £2,100 in wasted ingredients over three months.

When to Adjust Your Benchmarks

Benchmarks aren’t set in stone. They shift with your business, the economy, and your goals.

If you’re growing fast, your revenue per employee might dip temporarily because you’re hiring. That’s okay-as long as it rebounds in 4-6 months. If your inventory turnover drops because you’re testing a new product line, that’s a test, not a failure.

But if your employee utilization stays below 55% for six months? That’s a red flag. Same with CAC/LTV below 2:1. Those aren’t trends. They’re warnings.

Tools That Actually Help (Without Costing a Fortune)

You don’t need fancy systems. Here are free or low-cost tools UK SMEs use to track these metrics:

- Xero or QuickBooks → Tracks revenue, CAC, inventory costs

- Google Sheets → Build your own dashboard for fulfillment time and utilization

- Calendly or Acuity → Tracks service booking-to-completion time

- Shopify or WooCommerce reports → Shows inventory turnover and customer LTV

One Nottingham-based plumbing business used Google Sheets and a simple formula to calculate daily labor efficiency. They didn’t buy a new system. They just started asking: ‘How many jobs did each technician complete today?’ Within three months, they increased jobs per day from 2.1 to 3.4.

Final Thought: Metrics Are About Action, Not Reports

Operational metrics aren’t about looking smart. They’re about acting smart. They turn guesswork into decisions. They turn frustration into fixes.

If you’re an SME owner in the UK right now, you’re not fighting to be the biggest. You’re fighting to be the most efficient. The businesses that survive and grow aren’t the ones with the fanciest offices. They’re the ones who know exactly how much each hour, each pound, and each customer is worth.

Start small. Pick one metric. Track it for 30 days. Then another. You don’t need to fix everything at once. Just fix one thing at a time-and keep going.

What are the best operational metrics for a service-based UK SME?

For service-based SMEs like consultants, cleaners, or repair services, focus on: Revenue per Employee, Order Fulfillment Cycle Time, Employee Utilization Rate, Customer Acquisition Cost (CAC), and Customer Lifetime Value (LTV). These show how efficiently you’re delivering service and retaining clients. Avoid tracking website traffic or social media likes-they don’t reflect real business health.

How often should I review my operational metrics?

Review your key metrics every Monday morning. This gives you a weekly pulse check. Dig deeper once a month to spot trends. Adjust your benchmarks every quarter as your business changes. Don’t wait for quarterly accounts-by then, it’s too late to fix slow-moving problems.

Can I track operational metrics without spending money on software?

Yes. Most UK SMEs start with free tools: Xero or QuickBooks for financial data, Google Sheets for calculations, and calendar apps for tracking job completion times. You don’t need dashboards or AI tools. Just consistency. Write down your numbers, compare them week to week, and ask why things changed.

What’s a good revenue per employee benchmark for a UK SME?

The average for UK SMEs is £128,000 per employee. Top performers hit £180,000 or more. If you’re below £100,000, look at how your staff spend their time. Are they doing low-value tasks? Can automation or better processes free them up? This metric doesn’t mean you need to fire people-it means you need to use them better.

Why is inventory turnover important for retail SMEs?

Inventory turnover tells you how quickly you’re selling stock. A ratio below 4 means you’re holding too much unsold stock, tying up cash. Above 12 means you’re running out too often and losing sales. Healthy turnover for UK retail SMEs is between 6 and 8. This means you’re selling your entire stock every 2-3 months-balancing supply with demand without overstocking or understocking.

Next steps: Pick one metric from this list. Track it for the next 30 days. Write down what you learn. Then pick another. That’s how you build a business that doesn’t just survive-it thrives.