Quarterly Tax Payments in the UK: When and How to Pay Corporation and Income Tax

17 Jan, 2026Quarterly Tax Payments in the UK: When and How to Pay Corporation and Income Tax

If you run a business in the UK or earn income as a freelancer, contractor, or landlord, you’ve probably heard about quarterly tax payments. But here’s the truth: quarterly tax payments aren’t for everyone. Most people pay income tax once a year through Self Assessment. Only certain businesses and high earners make payments during the year. Confused? You’re not alone. Many assume all taxes are paid quarterly like in the U.S. That’s not how it works in the UK. Let’s clear up what’s real, what’s not, and exactly when and how you need to pay.

Who Actually Pays Quarterly Tax in the UK?

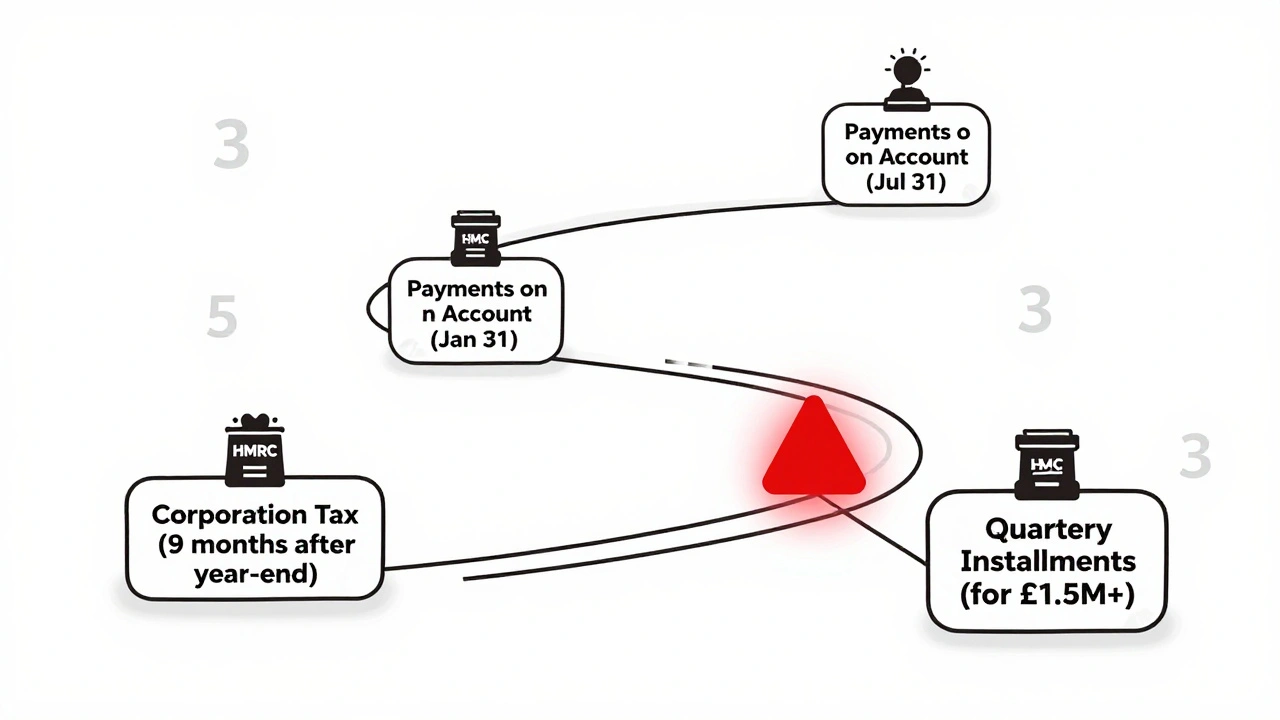

The UK doesn’t have a universal quarterly tax system like the U.S. Instead, it uses two different systems depending on your income type: Corporation Tax for companies, and Payments on Account for high-earning individuals.

Corporation Tax is paid by limited companies. It’s not quarterly. It’s due nine months and one day after your company’s accounting period ends. For example, if your financial year ends March 31, your Corporation Tax is due January 1 of the next year. But here’s the catch: if your annual tax bill is over £1.5 million, you must pay in installments - usually four quarterly payments. That’s the only time quarterly payments apply to Corporation Tax.

Payments on Account apply to individuals. If you owe more than £1,000 in income tax after deductions (like PAYE from a job), and your income comes from self-employment, property, or investments, HMRC will ask you to make two advance payments each year. These are due January 31 and July 31. They’re not called quarterly, but they’re spread across the year. If your tax bill is over £1,000, you’ll likely get these payments automatically.

So, who pays quarterly? Only large companies with tax bills over £1.5 million. Everyone else pays either once a year (Corporation Tax) or twice (Payments on Account). There’s no blanket quarterly rule.

How Corporation Tax Payments Work

Every limited company in the UK must file a Corporation Tax return (CT600) and pay the tax due. The deadline is always nine months and one day after the end of your accounting period. But if your company’s taxable profits are £1.5 million or more, you’re required to pay in installments.

Here’s how it breaks down:

- For profits between £1.5 million and £20 million: pay in four equal installments. Due at 6, 3, and 1 months before your accounting period ends, and then the final payment at the normal deadline.

- For profits over £20 million: pay in eight installments. HMRC sets the exact dates based on your accounting period.

For example, if your company’s accounting period runs from April 1, 2025, to March 31, 2026, and your taxable profit is £2.1 million, you’ll make four payments:

- October 1, 2025 (6 months before year-end)

- January 1, 2026 (3 months before year-end)

- March 1, 2026 (1 month before year-end)

- January 1, 2027 (normal deadline)

You can’t avoid these payments. HMRC will send you a notice if you’re required to pay in installments. If you miss one, you’ll get charged interest from the day it was due. No warnings. No grace periods.

Payments on Account for Self-Employed and High-Income Earners

If you’re self-employed, a contractor, or earn rental income, you file a Self Assessment tax return. If your total tax bill (after deductions) is over £1,000, HMRC will automatically set up Payments on Account.

These are two equal installments:

- First payment: January 31 (during the tax year)

- Second payment: July 31 (midway through the next tax year)

Each payment is half of what you owed the previous year. So if you paid £4,000 in income tax for 2024-2025, you’ll pay £2,000 on January 31, 2026, and another £2,000 on July 31, 2026.

But here’s what most people get wrong: these aren’t your final tax bill. They’re estimates. When you file your next Self Assessment return (by January 31, 2027), HMRC will calculate your actual tax for 2025-2026. If you paid too much, you get a refund. If you paid too little, you owe the rest - plus any balancing payment due January 31, 2027.

You can reduce or cancel Payments on Account if you expect your income to drop. For example, if you’re retiring or your business is slowing down, you can apply to HMRC to lower your payments. Use form SA303 or log into your online HMRC account.

How to Pay Your Taxes

HMRC accepts several payment methods. But not all are created equal.

- Bank transfer (BACS): Free, reliable, and takes 3-5 working days. Best for large payments.

- Debit or corporate credit card: Instant, but HMRC charges a 0.4% fee. Only use if you need to pay immediately.

- Direct Debit: Set up automatic payments. You control the date and amount. Great for Payments on Account.

- Online banking: Pay through your bank’s app using HMRC’s payment reference number. Always double-check the reference - if it’s wrong, your payment won’t be matched.

- CHAPS: Same-day transfer. Costs £25-£30. Only use if you’re paying the day before the deadline and need guaranteed clearance.

Never use cash or checks. HMRC doesn’t accept them anymore. And don’t wait until the last day. Payment processing takes time. If you pay on January 31 at 11:59 PM, it might not clear until February 1. That’s late. Set a reminder to pay at least three business days before the deadline.

What Happens If You Miss a Payment?

HMRC doesn’t send warnings. They don’t call. They don’t email. If you miss a payment, interest starts charging immediately.

For Corporation Tax and Payments on Account, the interest rate is 7.25% per year (as of 2026). That’s 0.6% per month. So if you owe £5,000 and pay 30 days late, you’ll pay £30 in interest - on top of your tax bill.

Penalties only kick in if you’re more than 30 days late. Then you’ll get a £100 fine. After 6 months, another £100. After 12 months, another £100 or 5% of the unpaid tax - whichever is higher.

But here’s the thing: if you’re struggling to pay, HMRC will work with you. Call them before your deadline. Explain your situation. They can set up a Time to Pay arrangement. You’ll still pay interest, but no penalties. And you’ll avoid a formal enforcement notice.

Common Mistakes and How to Avoid Them

Here are the top three mistakes people make:

- Confusing Corporation Tax deadlines with Self Assessment. Company tax is due nine months after your year-end. Personal tax is due January 31. Mixing them up leads to late payments.

- Forgetting Payments on Account are estimates. If your income drops, you’re still paying based on last year’s bill. Update HMRC if your earnings are changing.

- Using the wrong payment reference. Corporation Tax needs your Company Registration Number. Self Assessment needs your Unique Taxpayer Reference (UTR). Use the wrong one, and your payment disappears into a black hole.

Pro tip: Keep a simple spreadsheet. List your accounting period end dates, tax due dates, and payment amounts. Update it every time you file a return. Set calendar reminders 10 days before each deadline.

When to Get Professional Help

If you’re a small business owner with a tax bill under £10,000 and stable income, you can handle this yourself. Use HMRC’s online services and free accounting software like QuickBooks or Xero.

But if you’re:

- Running a company with profits over £1.5 million

- Dealing with multiple income streams (rental, freelance, dividends)

- Planning to reduce Payments on Account

- Missed a payment and don’t know what to do next

- then hire an accountant. A good one will save you more than their fee by avoiding penalties, spotting deductions, and setting up payment plans before you’re penalized.

Final Checklist: Your Quarterly Tax Action Plan

Here’s what you need to do right now:

- Check your last Corporation Tax bill. If it was over £1.5 million, you’re paying quarterly. Mark your four payment dates.

- Log into your HMRC online account. Look for Payments on Account. If you owe over £1,000, you’ll see them listed.

- Confirm your accounting period end date. That’s your Corporation Tax deadline.

- Review your 2024-2025 income. If it’s lower than last year, apply to reduce your Payments on Account.

- Set up Direct Debit for Payments on Account. It’s automatic, reliable, and free.

- Save your Company Registration Number and UTR. Keep them in a safe place.

Tax deadlines aren’t suggestions. They’re legal requirements. But with the right system, you won’t just meet them - you’ll stay calm while everyone else is scrambling.

Do I have to pay quarterly tax if I’m self-employed?

No, not quarterly. If you’re self-employed and owe more than £1,000 in tax after deductions, you’ll make two Payments on Account - one on January 31 and another on July 31. These are half of your previous year’s tax bill. They’re not called quarterly, but they’re spread across the year. You only pay once a year after filing your Self Assessment return.

Is Corporation Tax paid quarterly in the UK?

Only if your company’s annual Corporation Tax bill is over £1.5 million. Then you pay in four installments: 6, 3, and 1 months before your accounting period ends, plus the final payment at the normal deadline (nine months after). For most small businesses, Corporation Tax is paid once a year.

What happens if I miss a tax payment deadline?

Interest starts charging immediately - currently 7.25% per year. After 30 days late, you get a £100 penalty. After six months, another £100. After 12 months, another £100 or 5% of what you owe, whichever is higher. But if you contact HMRC before the deadline, you can set up a payment plan and avoid penalties.

Can I reduce my Payments on Account if my income is falling?

Yes. If you expect your income to be lower this year, you can apply to reduce your Payments on Account. Log into your HMRC online account and use form SA303. You’ll need to estimate your current year’s tax liability. HMRC will adjust your payments if your estimate is reasonable.

How do I know if I need to pay Corporation Tax in installments?

HMRC will notify you if your company’s annual tax bill exceeds £1.5 million. You’ll receive a letter or message in your online HMRC account. If you’re unsure, check your last Corporation Tax return. If your taxable profit was over £1.5 million, you’re likely paying in installments.