Revenue Retention in the UK: Net vs Gross and Expansion Benchmarks

30 Jan, 2026If you run a subscription business in the UK, you’re probably hearing a lot about revenue retention. But what does it actually mean when someone says your net revenue retention is 115%? And why does that number matter more than your gross retention? The truth is, most companies measure retention wrong - and they’re making decisions based on misleading numbers.

What’s the difference between gross and net revenue retention?

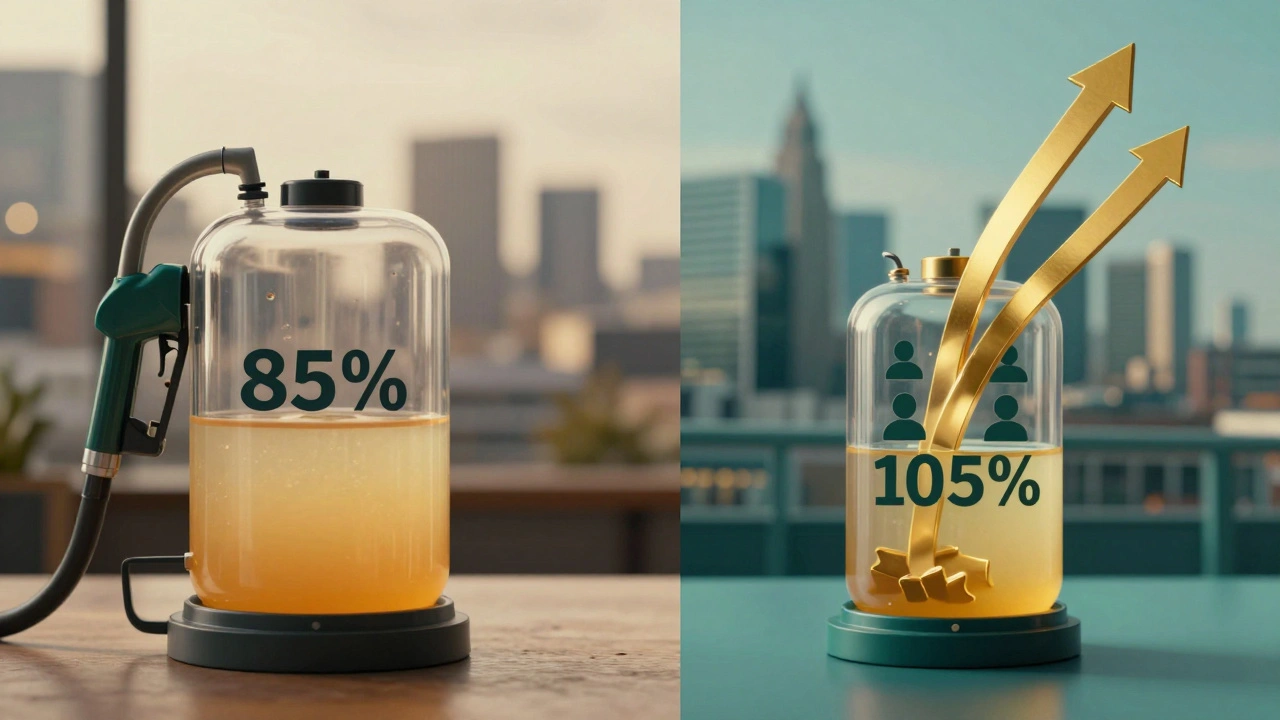

Gross revenue retention tells you how much money you kept from existing customers over a period - without counting any extra money they spent. It’s like checking your car’s fuel tank: how much gas is still left after driving? If you started the year with £100,000 in recurring revenue from 100 customers, and £15,000 of that vanished because customers canceled or downgraded, your gross retention is 85%. That’s simple.

Net revenue retention adds one more layer: it includes the money those same customers gave you *after* they stayed. That’s upsells, cross-sells, upgrades - anything extra beyond what they originally paid. So if those same 100 customers spent another £20,000 on new features, add-ons, or higher tiers, your net retention becomes 105%: you kept £85,000 and added £20,000 more, totaling £105,000 from the original group.

That’s the difference between survival and growth. Gross retention says you’re holding on. Net retention says you’re growing even without new customers.

Why UK businesses get this wrong

In the UK, SaaS companies often focus too much on new customer acquisition. Sales teams are rewarded for landing new deals. Marketing pushes for more sign-ups. But if you’re losing 20% of your revenue every year from churn, no amount of new sales will fix that. A company with 120% net revenue retention can grow 20% a year just by keeping its existing customers happy. That’s the magic.

Many UK businesses report gross retention as their main metric because it looks better. If your gross retention is 90%, you might think you’re doing fine. But if your net retention is 88%, you’re actually losing money from your existing base. That’s not a retention problem - it’s a product or customer success problem.

Real leaders look at net retention first. If it’s below 100%, you’re bleeding money from your best customers. If it’s above 110%, you’ve built something people want to spend more on.

What are the UK benchmarks for 2026?

According to the latest SaaS Benchmarks Report from the UK SaaS Association (2025 data), here’s what top-performing companies are seeing:

- Net Revenue Retention (NRR): 105%-125% for mature SaaS companies (over 3 years old)

- Gross Revenue Retention (GRR): 85%-92% - anything below 80% is a red flag

- Expansion Revenue: 15%-25% of total revenue comes from upsells and cross-sells to existing customers

- Churn Rate: 5%-8% annual revenue churn for healthy businesses

Companies hitting 120%+ NRR are rare - only about 12% of UK SaaS firms make it there. But they’re growing 3x faster than the average. They’re not just keeping customers. They’re turning them into advocates who pay more.

For early-stage UK startups (under 2 years), NRR above 95% is good. Below 90% means you need to fix your onboarding or pricing. Don’t wait until you have 100 customers to fix this.

What drives expansion revenue in the UK market?

Not all upsells are created equal. In the UK, expansion revenue comes from three main sources:

- Feature adoption: Customers who use more features spend more. Companies that track feature usage and trigger in-app prompts see 30% higher expansion rates.

- Usage-based pricing: If you charge per user, per API call, or per GB, usage naturally grows - and so does revenue. UK firms using usage-based models report 22% higher NRR than flat-fee competitors.

- Customer success outreach: Proactive check-ins with customers who hit usage milestones lead to 40% more upsells. It’s not about selling. It’s about helping them succeed - then letting them see the value of paying more.

One London-based HR SaaS company saw their expansion revenue jump from 8% to 21% in 12 months by simply training their customer success team to ask one question: “What’s the next problem you need to solve?” Not “Would you like to upgrade?” - but “What’s next?” That shift in language changed everything.

How to track and improve your retention

You can’t improve what you don’t measure. Here’s how to set up real tracking:

- Calculate GRR monthly: (Starting MRR - Churned MRR) / Starting MRR

- Calculate NRR monthly: (Starting MRR - Churned MRR + Expansion MRR) / Starting MRR

- Segment by customer tier: Are your enterprise clients keeping 130% NRR while your SMBs are at 85%? That’s a red flag.

- Track expansion sources: Is it upgrades? Add-ons? More users? Know where the growth is coming from.

- Set a monthly NRR goal: Aim for 105%+ if you’re past Year 2. If you’re below 100%, treat it like a crisis.

Use your CRM or billing system to auto-calculate this. Don’t do it manually. If you’re using Stripe, Paddle, or Chargebee, they have built-in retention dashboards. If you’re still using Excel, you’re already behind.

When to worry - and what to do

Here’s a simple guide:

- NRR below 90%: You’re losing more than you’re gaining. Fix your onboarding. Are customers confused? Are they not seeing value in the first 30 days?

- NRR between 90%-100%: You’re treading water. Start tracking feature adoption. Who’s using the core features? Who’s not? Build nudges for the latter.

- NRR above 105%: You’re in the top tier. Double down on customer success. Reward referrals. Build case studies.

Don’t ignore churn. Even if your NRR is high, if your gross retention is below 80%, you’re spending too much on acquiring replacements. Fix the root cause - poor product-market fit, bad onboarding, or unresponsive support.

One Manchester-based cybersecurity firm cut churn by 40% in six months by adding a 14-day check-in call for every new customer. No sales pitch. Just: “How’s it going? What’s working? What’s not?” They didn’t upsell once. They just listened. And retention soared.

Net retention isn’t a vanity metric - it’s your growth engine

Investors don’t care how many new customers you got last quarter. They care if you can grow from your existing base. A company with 115% net revenue retention can raise capital at higher valuations. It can weather economic downturns. It doesn’t need to spend half its budget on sales to grow.

In the UK, where competition is fierce and customer loyalty is harder to earn, net retention is the only metric that matters long-term. Gross retention tells you what you lost. Net retention tells you what you built.

If you’re not measuring both - and acting on the gap between them - you’re flying blind.

What’s a good net revenue retention rate for a UK SaaS company in 2026?

A good net revenue retention (NRR) for a UK SaaS company in 2026 is between 105% and 125%. Companies above 120% are in the top 10% and typically grow faster than their competitors. Startups under two years should aim for at least 95%. Anything below 90% means you need to fix customer onboarding, product value, or support.

Is gross revenue retention important?

Yes - but only as a diagnostic tool. Gross revenue retention shows how much you’re losing to churn and downgrades. If your gross retention is below 80%, you have a serious retention problem. But if your net retention is high while gross is low, it means your customers are upgrading enough to offset losses - which is actually a good sign. The real focus should be on net retention, since it reflects true growth from your existing base.

How do I increase expansion revenue?

Focus on helping customers succeed. Track which features they use and which they ignore. Send targeted tips when they hit usage milestones. Offer usage-based pricing so their spend grows naturally. Train your customer success team to ask, “What’s the next problem you need to solve?” instead of pushing upgrades. Companies that do this see 30-40% higher expansion rates.

Why is net retention more important than new sales?

Because acquiring a new customer costs 5-7x more than keeping an existing one. If you can grow 15% a year just from your current customers - through upsells and better usage - you don’t need to spend heavily on sales and marketing. Net retention is the most efficient growth engine in subscription businesses. Investors know this. That’s why companies with high NRR get better valuations.

What tools should I use to track revenue retention?

Use your billing platform. Stripe, Paddle, Chargebee, and Recurly all calculate net and gross retention automatically. If you’re using Excel or manual spreadsheets, you’re wasting time and risking errors. Connect your CRM (like HubSpot or Salesforce) to your billing system to track customer health scores and expansion triggers. Most tools have dashboards built in - just turn them on.

If you’re not measuring net revenue retention, you’re guessing at your business’s health. The data doesn’t lie - companies that obsess over this number grow faster, raise money easier, and survive downturns better. In the UK, where margins are tight and customers are savvy, retention isn’t a nice-to-have. It’s your only real advantage.