Treasury Management for UK Small Businesses: Short-Term Investments and Risk

11 Dec, 2025Most UK small business owners think treasury management is something only big companies worry about. That’s a mistake. If you’re running a small business in the UK and you’re not actively managing your cash, you’re leaving money on the table-and risking your survival. It’s not about fancy spreadsheets or finance degrees. It’s about knowing where your money is, how safe it is, and how to make it work harder without putting your business at risk.

Why Treasury Management Matters More Than You Think

Let’s say you’ve just landed a big client. You’ve got £50,000 sitting in your business bank account. It’s safe. But it’s also earning next to nothing-maybe 0.01% interest. Meanwhile, inflation is still hovering around 2.5%. That means every month, your cash is slowly losing value. You’re not losing it overnight. But over a year? You’ve lost over £1,200 just from sitting still.

That’s not a hypothetical. A 2024 survey by the Federation of Small Businesses found that 68% of UK small businesses keep over 40% of their available cash in standard current accounts. And nearly half of them don’t even know what their cash is earning. That’s not smart. That’s just default.

Treasury management isn’t about speculation. It’s about control. It’s about knowing exactly how much cash you need to cover payroll, rent, and suppliers-and putting the rest to work in low-risk ways that still beat inflation.

What Counts as a Short-Term Investment for Small Businesses

When we say “short-term,” we mean investments you can turn back into cash within 90 days, sometimes even 24 hours. These aren’t stocks, crypto, or property. They’re safe, liquid, and regulated. Here’s what actually works for UK small businesses right now:

- Business savings accounts with instant or 30-day access. Some offer 4.5%+ AER if you meet minimum balance requirements (often £5,000-£10,000).

- Notice accounts that pay 4.2%-5% if you give 30-90 days’ notice before withdrawing. Perfect for cash you know you won’t need for a few months.

- Instant access ISAs for business owners who are sole traders or partners. You can hold up to £20,000 tax-free per year in cash ISAs, and some providers let you open business cash ISAs.

- Money market funds managed by UK-regulated firms. These invest in short-term government bonds and corporate debt. They’re not guaranteed, but they’re among the safest investment vehicles outside of bank deposits.

- Commercial paper through platforms like Funding Circle or MarketInvoice. These let you lend directly to other small businesses for 30-180 days at 5%-7% returns. Riskier than savings accounts, but still far safer than stocks.

Don’t be tempted by anything promising 8% or more. If it sounds too good to be true, it is. The Financial Conduct Authority (FCA) has issued multiple warnings about high-yield “investment” schemes targeting small businesses. In 2023 alone, over £12 million was lost by UK small firms to unregulated schemes disguised as treasury products.

How to Balance Risk and Return Without Losing Sleep

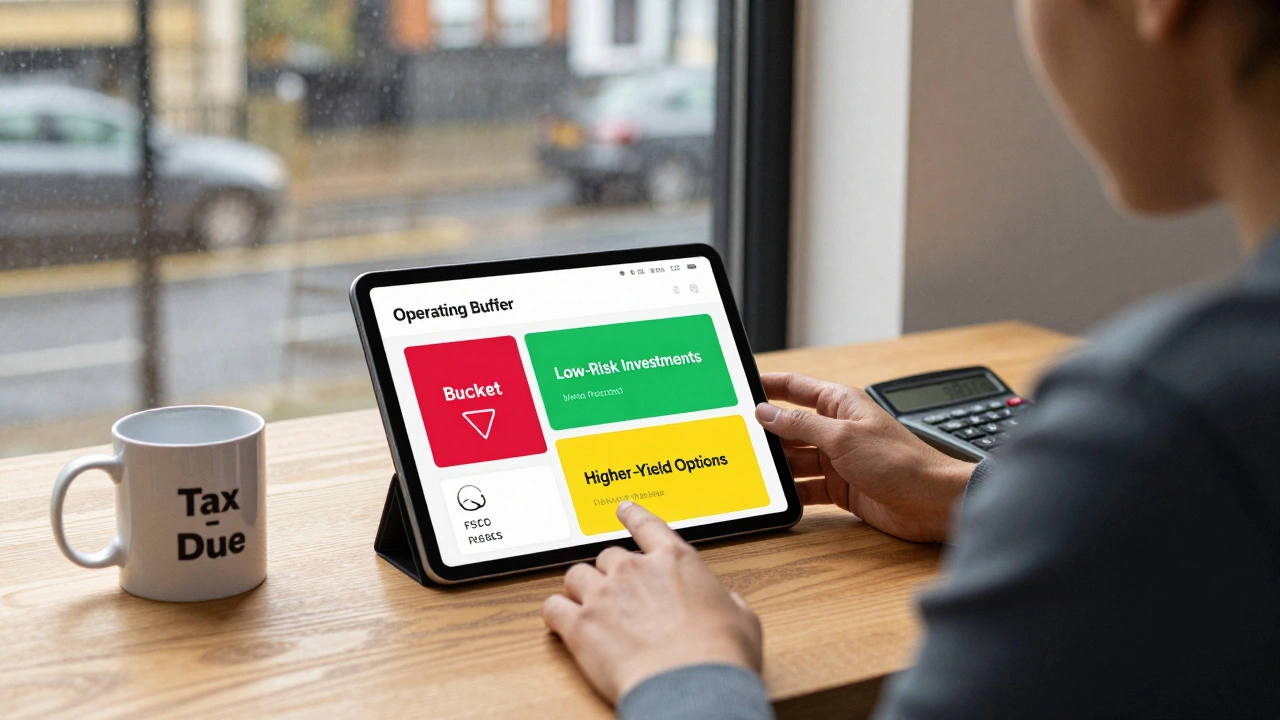

You don’t have to choose between safety and growth. You can have both. The trick is to divide your cash into buckets.

Start with your operating buffer. This is the money you need to cover 30-60 days of expenses. Keep this in an instant access account with FSCS protection (up to £85,000 per institution). That’s non-negotiable. If your bank fails, you’re covered.

Then take your surplus cash-the amount above your operating buffer-and split it into two parts:

- 60% in low-risk, liquid options: Notice accounts, money market funds, or short-term corporate bonds. These should be accessible within 14-30 days if needed.

- 40% in slightly higher-yield options: Commercial paper, peer-to-peer lending platforms, or fixed-term business deposits (6-12 months). Only use platforms regulated by the FCA. Check their authorisation status before depositing.

For example: If you have £100,000 in surplus cash, put £60,000 into a 60-day notice account paying 4.8% and £40,000 into a 9-month fixed-rate business bond paying 5.9%. You’re earning an average of 5.2% on your surplus-and you can still access most of it within 30 days if an emergency hits.

The Hidden Risks No One Talks About

Most people think the biggest risk is losing money. But the real danger? Not having access when you need it.

Here’s what goes wrong:

- Putting cash into a 12-month fixed deposit, then needing £20,000 to cover a tax bill. You’re stuck paying early withdrawal penalties.

- Investing in a platform that promises high returns but has no FSCS protection. If the platform collapses, you lose everything.

- Spreading cash across too many accounts. You lose track. You forget which one has the money you need.

Another hidden risk: currency exposure. If you import goods or sell to EU customers, and your cash is in GBP, you’re exposed to exchange rate swings. Even if you’re not trading internationally now, you might be soon. Consider multi-currency business accounts from providers like Wise or Revolut. They let you hold EUR, USD, and GBP in one place, with low fees and real-time rates.

And don’t ignore fraud risk. Business bank accounts are prime targets. Enable two-factor authentication. Set up payment limits. Require dual approval for transfers over £5,000. Most banks offer these tools-but most small business owners never turn them on.

Tools That Actually Help

You don’t need a finance team. But you do need the right tools.

- QuickBooks or Xero with cash flow forecasting. These tools can show you exactly when money is coming in and going out. Set alerts for when your balance drops below your operating buffer.

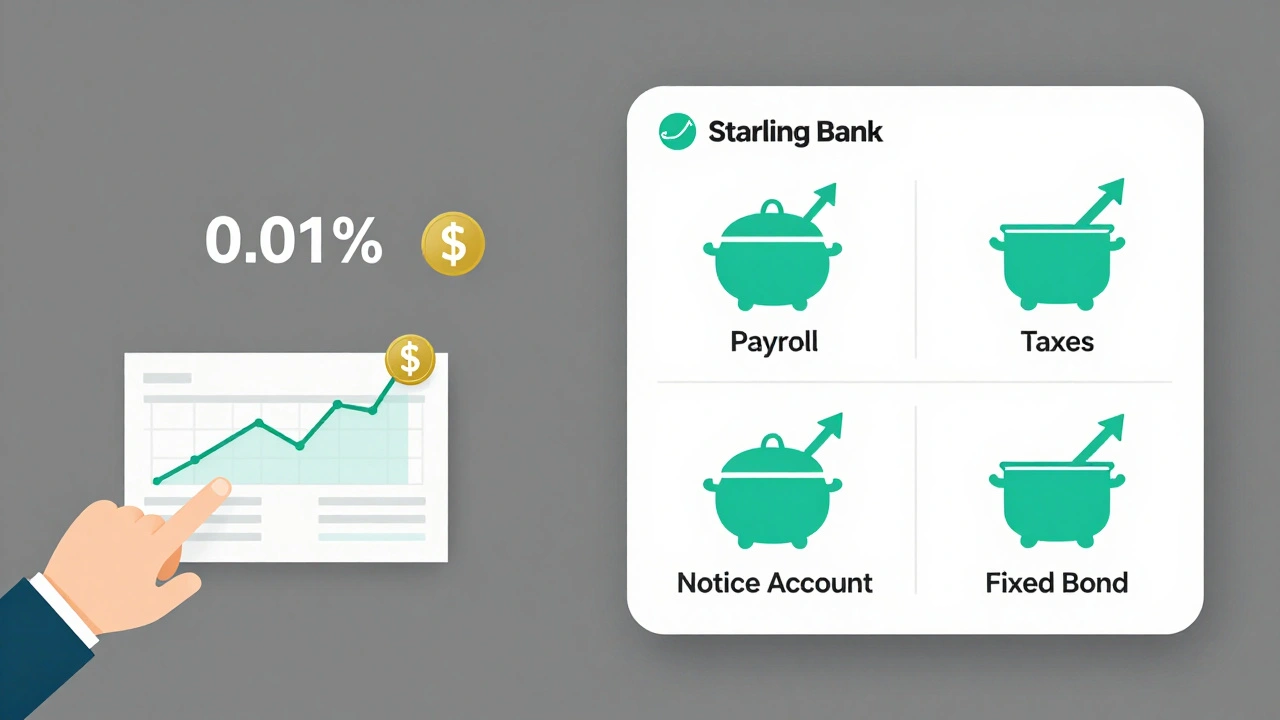

- Monzo for Business or Starling Bank for real-time balance tracking and instant savings pots. You can create separate “pots” for different goals-payroll, taxes, investments-and move money between them in seconds.

- FCA register (fca.org.uk/register) to check if any investment platform you’re considering is authorised. Type in the company name. If it’s not there, walk away.

- Bank of England’s inflation calculator to see how much your cash is really losing each month. It’s free. It’s accurate. Use it.

One business owner in Manchester started using Starling’s “Savings Pots” to automatically move £2,000 from her current account into a 30-day notice account every time her balance hit £15,000. In six months, she earned £480 in interest on money she wasn’t even thinking about. That’s £40 a month in free cash.

What to Do Next

Here’s your three-step plan to get started this week:

- Calculate your operating buffer. Add up your monthly rent, payroll, utilities, and taxes. Multiply by 2. That’s your safety net. Keep it in an instant access account with FSCS protection.

- Find one better place for your surplus cash. Look at your current bank’s business savings options. If they’re offering less than 3%, switch. Compare at MoneySavingExpert or Bankrate UK.

- Set up one automation. Whether it’s moving £1,000 a week into a notice account or enabling dual approval for payments, make one change that reduces your risk and increases your return.

You don’t need to do everything at once. But if you do nothing, you’re already losing money. Every day your cash sits idle, inflation eats at it. The goal isn’t to become a financial expert. It’s to stop being careless with money you worked hard to earn.

Frequently Asked Questions

What’s the safest short-term investment for UK small businesses?

The safest options are business savings accounts and notice accounts offered by UK-regulated banks and building societies. These are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per institution. Money market funds are also low-risk but aren’t FSCS-protected-so only use those with reputable, FCA-authorised fund managers.

Can I use a personal ISA for my business cash?

No. Personal ISAs are only for individual savings. However, some providers like Wealthfront and Fidelity offer business cash ISAs for sole traders and partnerships. These work like personal ISAs but are held in the business’s name. Check with your provider to confirm eligibility.

How often should I review my treasury strategy?

Review your cash positions every quarter. If interest rates change significantly, or if your cash flow patterns shift (like a big seasonal spike), adjust your allocations. Don’t wait for a crisis. Small tweaks every few months make a big difference over time.

Is peer-to-peer lending safe for business cash?

It can be, if you stick to FCA-authorised platforms like Funding Circle or RateSetter. These platforms offer diversification across multiple borrowers and have reserve funds to cover defaults. But remember: you’re not protected by FSCS. Only invest money you can afford to lose, and keep it under 20% of your total surplus cash.

What happens if my bank fails?

If your bank is UK-regulated and covered by FSCS, your first £85,000 in business savings is protected. You’ll get your money back within seven working days. Always check that your bank is FSCS-protected before depositing. If you have more than £85,000, split it across two or more banks.