UK Minimum Wage Requirements for 2025: Rates by Age and Apprentice Status

8 Feb, 2026Starting April 1, 2025, the UK’s minimum wage rates changed again - and if you’re paying employees in Britain, you need to know exactly what you owe. This isn’t about guesswork. Getting it wrong can cost you thousands in penalties, back pay, and reputational damage. The rules are clear, and they’re based on two things: how old your worker is, and whether they’re an apprentice. No exceptions.

What’s the National Living Wage in 2025?

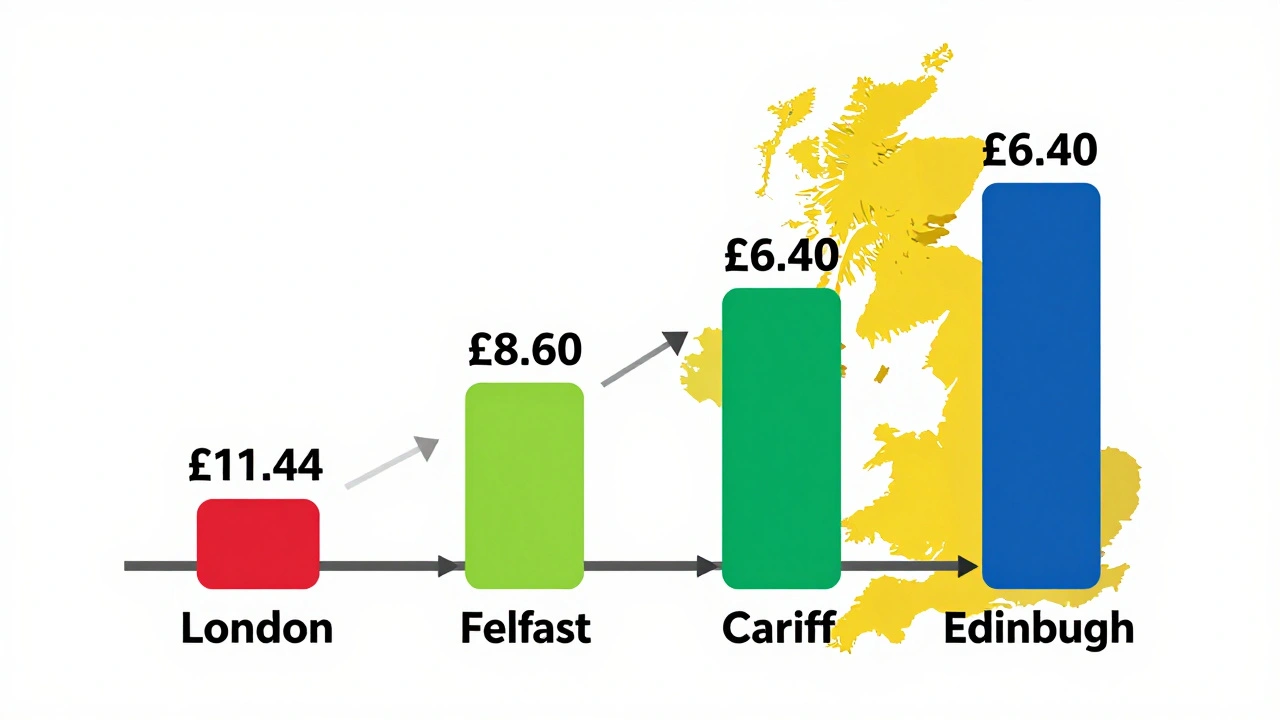

The National Living Wage is the highest minimum wage rate in the UK, and it applies to workers aged 21 and over. In 2025, that rate is £11.44 per hour. This isn’t a suggestion. It’s the law. If you pay someone 21 or older less than this, you’re breaking UK employment law - even if they agreed to it.

This rate replaced the old National Minimum Wage for workers 23 and over, which was rolled into the National Living Wage in 2024. So now, if someone is 21, 25, or 65 - as long as they’re not an apprentice - they must earn at least £11.44 an hour. No rounding down. No exceptions for small businesses. No "I didn’t know" defense.

Minimum Wage Rates for Workers Under 21

If your employee is under 21, the rate drops - but not by much. Here’s the breakdown for 2025:

- 18 to 20 years old: £8.60 per hour

- Under 18 years old: £6.40 per hour

These rates aren’t optional. A 19-year-old working part-time at a café still needs to earn £8.60/hour, even if they’re new or only work 10 hours a week. Same goes for a 16-year-old stocking shelves - they’re entitled to £6.40, no matter how "entry-level" the job seems.

Many employers assume younger workers are cheaper to hire. That’s true - but only within these legal limits. Paying below these rates, even for a trial period or "training wage," is illegal. HMRC doesn’t care if you’re a one-person shop or a chain with 500 employees. They audit.

Apprentice Wage Rate - What You Need to Know

Apprentices have their own rate, and it’s different from the age-based rates. In 2025, the apprentice minimum wage is £6.40 per hour.

But here’s the catch: this rate only applies if the apprentice is either:

- Under 19 years old, OR

- 19 or older, but in their first year of the apprenticeship

Once an apprentice turns 19 and completes their first year, they move to the standard rate for their age. So if a 20-year-old apprentice finishes Year 1 in June 2025, their pay must jump to £8.60/hour starting July 1 - even if they’re still in training.

Some employers think apprentices are just "trainees" and don’t need full wages. That’s a dangerous myth. An apprentice is an employee. They’re entitled to holiday pay, sick pay, and the minimum wage - no matter how much training they’re getting. If you’re not paying them correctly, you’re risking an HMRC investigation.

How Pay Periods and Overtime Affect Compliance

The minimum wage is calculated based on gross pay over a pay period - usually weekly or monthly. That means:

- Only cash wages count. Tips, service charges, and bonuses don’t count unless they’re guaranteed.

- Uniforms or equipment costs can’t reduce pay below the minimum. If you require a uniform and deduct £20 from their paycheck, that’s illegal.

- Overtime must be paid at least the minimum rate. If someone works 50 hours in a week and you pay £10/hour for the extra 10 hours, that’s fine - as long as the average over the whole week meets the minimum.

Many employers get tripped up by salary-based roles. If you pay someone £1,800 per month for 40 hours a week, you must check: £1,800 ÷ 17.33 hours per week (40 hours × 4.33 weeks) = £103.86 per week. That’s £2.60 per hour - way below minimum. That’s not a salary. That’s a violation.

Use this simple formula to check compliance: Total gross pay ÷ total hours worked ≥ minimum wage rate. Do this every pay cycle. It takes 90 seconds.

What Happens If You Get It Wrong?

HMRC doesn’t just send a warning. They issue a Notice of Underpayment, which includes:

- Back pay owed to the worker (for up to 6 years)

- A fine of up to 200% of the underpaid amount

- Public naming on the government’s non-compliance list

In 2024, HMRC recovered over £27 million in unpaid wages and fined employers more than £11 million. One small bakery in Manchester was named publicly after underpaying five staff by £1.20/hour for 18 months. Their social media following dropped 70% in a week.

It’s not just about money. It’s about trust. Workers are more aware than ever. Platforms like the Pay and Work Rights Helpline make it easy for employees to report violations anonymously. If you’re cutting corners, someone will find out.

How to Stay Compliant - A Simple Checklist

Here’s what you need to do right now:

- Check every employee’s age and apprenticeship status.

- Match each to the correct 2025 rate.

- Review payroll records for the last 6 months - look for any pay below the minimum.

- Update your payroll system or spreadsheet with the new rates.

- Train your managers - they shouldn’t be making pay decisions.

- Keep signed timesheets and pay records for at least 3 years.

If you use payroll software, make sure it’s updated. Most major systems (like QuickBooks, Sage, and Xero) auto-update rates - but you need to confirm it’s turned on.

Common Mistakes Employers Make

Here are the top 3 errors I see every year:

- "They’re on a trial" - There’s no such thing as a trial period where minimum wage doesn’t apply. Pay from Day 1.

- "They’re on a zero-hours contract" - Same rule. Even if they work 3 hours a week, they still get £11.44/hour for those hours.

- "We pay them in tips" - Tips don’t count unless they’re pooled and guaranteed. Cash tips in the pocket? Doesn’t count toward minimum wage.

There’s no gray area. The law doesn’t care if you’re busy, short on cash, or new to hiring. If you pay less than the rate, you’re breaking the law.

Where to Find Official Updates

The UK government publishes the official rates on the GOV.UK website. Bookmark it. Check it every January. Rates change every April. No exceptions.

Don’t rely on blogs, forums, or even your accountant unless they specifically specialize in UK employment law. The rules are set by the Low Pay Commission and approved by Parliament. They’re not opinions. They’re facts.

What About Workers in Northern Ireland?

Same rates. The UK minimum wage applies to all workers in Great Britain and Northern Ireland. There are no regional variations. Whether you’re hiring in London, Belfast, or Cardiff - the rates are identical.

Final Reminder

Minimum wage isn’t a cost to minimize. It’s a legal baseline. Paying it correctly protects your business as much as it protects your workers. If you’re unsure about someone’s status - ask HMRC. They’ll help. But they won’t forgive you for not knowing.

Does the minimum wage apply to self-employed workers?

No. The UK minimum wage only applies to workers who are classified as employees or workers under employment law. Self-employed individuals, freelancers, and contractors who run their own businesses are not covered. However, if someone is labeled as "self-employed" but you control their hours, tasks, and how they’re paid - HMRC may reclassify them as a worker. That’s when you owe them minimum wage.

Can I pay an apprentice less than the apprentice rate if they’re doing easy tasks?

No. The apprentice rate is based on age and apprenticeship status - not task difficulty. Whether they’re sweeping floors or operating machinery, if they’re officially registered as an apprentice and meet the criteria, they must be paid at least £6.40/hour in 2025. Paying less because the work seems "simple" is still illegal.

What if I hire someone who turns 21 mid-year?

You must increase their pay to the National Living Wage rate (£11.44/hour) on their 21st birthday. You can’t wait until the next pay cycle or the next month. The law requires the raise to take effect on the exact date they turn 21. Many payroll systems auto-adjust, but you should manually verify it happens.

Do I need to pay minimum wage during unpaid training days?

Yes. If the training is mandatory and you’re the one requiring it, the worker must be paid. Even if it’s outside regular hours - like a Saturday orientation - you owe them at least the minimum wage for that time. Unpaid training is only legal if it’s truly voluntary and not required for the job.

Are tips and service charges included in minimum wage calculations?

Only if they’re guaranteed and paid through payroll. If a customer leaves a cash tip directly to a server, that doesn’t count. If your business pools tips and distributes them as part of salary - and you’ve told workers they’ll receive it - then yes, it counts. But you must declare it on payslips. Unofficial tip sharing doesn’t count toward minimum wage compliance.